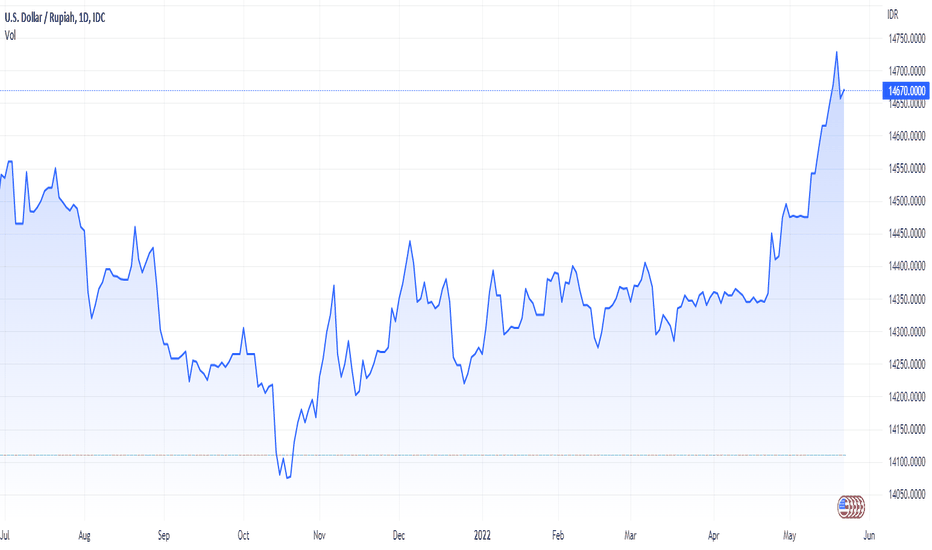

Bank Indonesia (BI) hiked rates by 50 bps as expected. Nonetheless, economists at TD Securities expect the USD/IDR to advance nicely toward the 15,832 resistance.

Another 50 bps hike cannot be discounted if IDR weakens aggressively

“BI hiked by another 50 bps, bringing the 7-day reverse repo rate to 4.75%. BI Governor Warjiyo noted that the hike was a ‘front-loaded, pre-emptive and forward-looking step to lower inflation expectations that are too high or overshooting’. However, we think the policy path ahead leans more on the pace of IDR depreciation given BI's historical focus on FX. Further, Warjiyo commented that the Bank wants to control the IDR to prevent imported inflation.”

“We see a gradual move for USD/IDR higher towards its next technical resistance level at 15,832 (76.4% Fib level over 5 yr-window).”

“BI likely won't tolerate any sharp one-sided moves in IDR and another 50 bps hike cannot be discounted if IDR weakens aggressively against the USD and compared to its regional peers.”

No comments:

Post a Comment